Has America Accelerated?

August 21, 2024

Acceleration nation? Has America’s potential GDP growth rate increased since the pandemic?

Or to put it another way: Is the maximum sustainable rate of US economic growth (without excess inflation, mind you) now higher than it was pre-COVID? If so, the welcome upgrade could be possibly due to factors like post-pandemic job market changes, the shift to remote work, or advancements in artificial intelligence.

To the top-line question, Eric Wallerstein, chief markets strategist at Yardeni Research, responds in the affirmative and offers some explanations:

Our answer is “yes.” This aligns with our views that: (1) strong immigration flows and record-high labor-force participation are growing the labor force (hence, the rise in the unemployment rate despite a healthy jobs market); and (2) productivity growth will boom over the rest of the decade as a result of widespread adoption of technologies like AI, automation, and robotics (as companies will need to augment their workforces with high tech despite the growing labor force).

Indeed, Wallerstein suggests in a new research note that the American economy’s potential GDP may be closer to 4.0 percent, significantly higher than the Federal Reserve’s long-run forecast of 1.8 percent.

(“The forecasts will be updated at the September meeting of the Federal Open Market Committee. Perhaps the FOMC members will realize that the economy is not operating above its potential and raise their forecasts. We aren’t holding our breath.”)

Interregnum. The Labor Department is now suggesting that the US job market from early 2023 to early 2024 was weaker than initially reported. Preliminary estimates indicate 818,000 fewer jobs added over 12 months through March. (Final revisions to official numbers expected in February.) These revised figures suggest 0.5 percent lower hours of growth from Q1 2023 to Q1 2024. And that implies productivity growth was 0.5 percentage points higher than reported, potentially 3.4 percent instead of 2.9 percent for this period. To that, you can add a strong second quarter this year of 2.3 percent.

CEPR economist Dean Baker: “So, it’s far too early to celebrate a pickup in productivity growth, but the downward revision to hours growth implied by today’s revision to the jobs data unambiguously raises the pace of productivity growth over the last year. In that sense, it is good news. But as with all economic data, it’s part of a big picture, and we can’t make too much of any specific data release in isolation.”

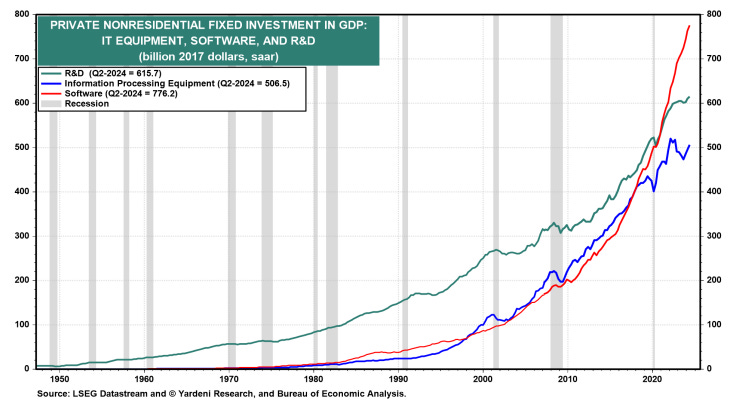

That four percent number would represent a significant glow-up. Some really “faster, please” kind of stuff, you know? Not the Technological Singularity, but I’ll take it. The pro-acceleration thesis here from Wallerstein: Investment drives productivity. Businesses are heavily investing in tech like software, R&D, and IT equipment. The benefits of these productivity-boosting technologies are expected to expand beyond the initial tech providers such as chipmaker Nvidia.

Looking at AI diffusion

So obviously this is, in large part, an AI/machine-learning/GenAI story. Will the next chapters of that story continue this optimistic technological tale? That depends on businesses big and small, across the economy, finding profitable and productivity-enhancing uses for these new techno-tools. On that issue, here are the relevant findings from “The Productivity Implications of How CFO Survey Firms are Using AI” from the Federal Reserve Bank of Richmond:

- AI adoption rates. About 20 percent of respondents adopted AI tools in the last year, with over 30 percent planning to adopt new labor-saving AI tools in the next 12 months. This indicates a growing trend in AI adoption among businesses.

- Current AI applications. Firms are primarily using AI for routine tasks, software development, financial tasks, and content creation. “[But] many fewer firms referred to organizational-level process or system enhancements using AI.” This suggests that companies are still taking a cautious, targeted approach to AI integration rather than implementing sweeping changes.

- Human oversight. Many companies still require human review and finalization of AI-generated content.

- Future plans and research. Many firms are researching AI opportunities and conducting pilots to assess potential impacts. “Looking ahead to the next 12 months, many firms described how they are researching opportunities for AI usage, such as ‘undertaking a pilot to assess the options for where AI could have an impact’ and ‘learning the nuances of AI integration.’”

From the report’s conclusion:

The transformative possibilities of AI will not happen quickly. New tasks might be created, new systems might emerge, and we might see organizational structures adapt to the new technology — none of which is evident in our surveys yet. … [The] potential for AI to affect productivity is impacted not just by the tasks that can be enabled by AI, but by the organization’s structure. Right now, the CFO Survey firms that are using AI are using it to make a set of tasks (such as accounting or job description generation) more efficient. But as everyone agrees, this is only the beginning.

Walmart and AI

Certainly, the folks at Walmart would agree that“this is only the beginning.” Indeed, Wallerstein points to the mega-retailer as an example of a company that has moved beyond AI experiment to AI implementation. There were some really tantalizing take-aways from the company’s earning call last week, in which top executives outlined how the company has enthusiastically embraced GenAI to enhance its e-commerce operations. For example: The company has used AI to rewrite and improve over 850 million product listings.

“Without the use of generative AI, this work would have required nearly 100 times the current headcount to complete in the same amount of time,” said CEO Doug McMillon, who added that the “use cases for this technology are wide-ranging and affect nearly all parts of our business, and we’ll continue to experiment and deploy AI and generative AI applications globally.”

Walmart is also developing an AI shopping assistant to help customers with specific queries and provide personalized recommendations. Additionally, it’s testing an AI assistant for marketplace sellers to streamline their experience. The company credits AI with enabling rapid expansion of their marketplace and improving the overall customer experience. Walmart’s e-commerce business has seen substantial growth, with a 22 percent increase globally from Q2 2023 to Q2 2024, which execs partially attribute to their AI-driven enhancements.

Back to the productivity future

Look, if Walmart finds AI to be super useful, it’s a powerful affirmation of the technology’s commercial value. What I also find interesting is that Walmart helped drive the 1990s productivity boom that I mention from time to time. It was an early adopter of barcode technology and computerized inventory management systems, which greatly improved efficiency.

As McKinsey noted back then, “In general merchandise (representing 16 percent of the total retail productivity growth acceleration), we found that Wal-Mart directly and indirectly caused the bulk of the productivity acceleration through ongoing managerial innovation that increased competitive intensity and drove the diffusion of best practice (both managerial and technological).”

Let’s hope what’s happening in Walmart and what we’re starting to see in the big-picture data are Up Wing harbingers of great, pro-productivity things to come.

Sign up for the Ledger

Weekly analysis from AEI’s Economic Policy Studies scholars