How the Crisis Decade Set the Stage for an up Wing 21st Century

October 28, 2024

Now this is the sort of policy debate I can get behind: “Could the Trump-Musk bromance force a NASA pivot to Mars?”

You can add it to other emerging issues, such as regulating advanced artificial intelligence and the nuclear energy revival, as signs that important technological advances are happening to such that policymakers need to think hard and make decisions about them. These are good problems to have, and ones that didn’t seem likely back in the gloomy 2010s — or, to be precise, the decade from 2007 through 2017. Call it the Crisis Decade.

Apparently the phrase, “It is always darkest before the dawn” comes from the 1650 book “A Pisgah Sight Of Palestine And The Confines Thereof” by Thomas Fuller: “’It is always darkest just before the Day dawneth.” The “Pisgah” in the title refers to one Old Testament translation of the name of the summit where God showed Moses the Promised Land but told him, “you will not cross over into it.”

The Terrible Tenties

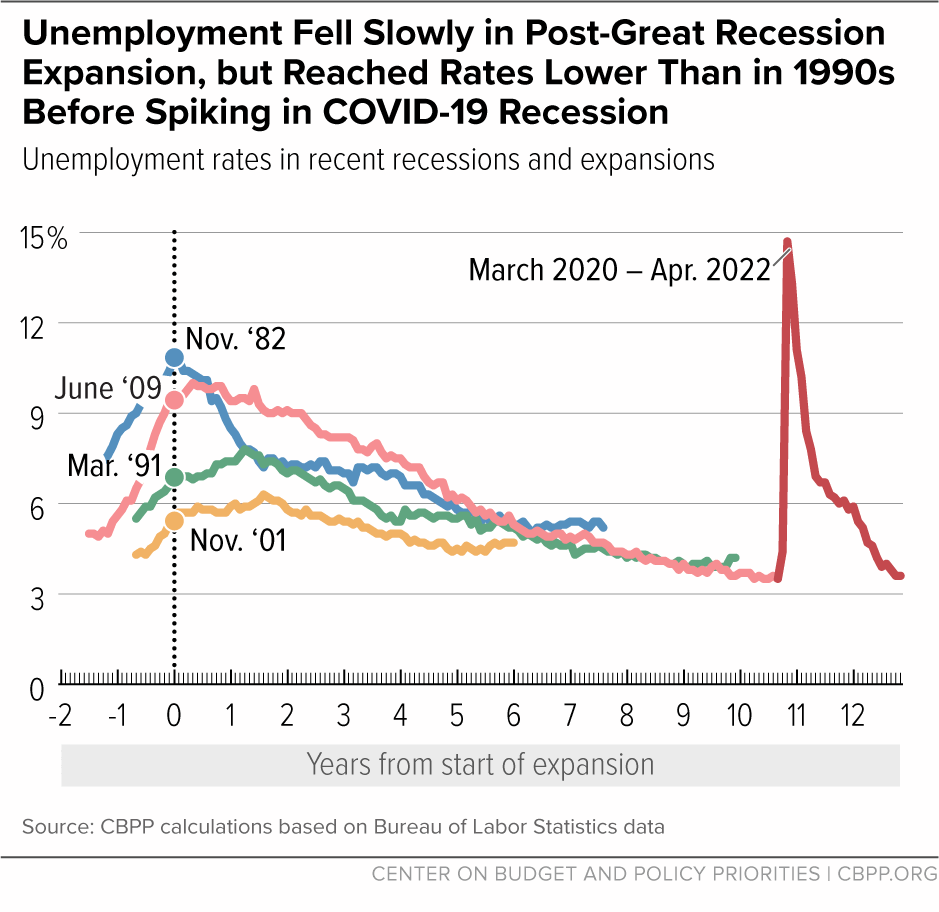

Turns out that “It is always darkest before the dawn” neatly captures recent history of technological progress and economic growth. Think about that Crisis Decade, the period beginning with the Global Financial Crisis and Great Recession in 2007–2009 then continuing through Not-So-Great Recovery until the US unemployment rate returned to pre-crisis levels in 2017. It was a period of considerable (and understandable) gloom about America’s future with lots of talk about “late capitalism,” “secular stagnation,” The Great Stagnation, and the overall death of the American Dream. Oh, and Peak Oil. Remember that? And to top it all off, the Space Shuttle program ended in 2011, closing off American access to low-Earth orbit without Russian help.

But beneath the decade-long doom, the ingredients for a long-term, Up Wing upturn were starting to come together:

- 2007. Apple CEO Steve Jobs announced the iPhone, which revolutionized mobile computing and created a trillion-dollar app economy.

- 2008. Hydraulic fracturing technology was proving successful for both natural gas and oil in multiple states, transforming global energy markets and making the US the world’s largest producer of both oil and gas. (The technique is also essential for today’s emerging advanced geothermal energy sector.)

- 2008. SpaceX’s first successful Falcon 1 launch became the first private rocket to reach orbit. This success validated SpaceX’s cost-effective approach to rocket development, saved the company from bankruptcy, and launched the modern commercial space industry.

- 2012. Researchers from the Lawrence Berkeley National Laboratory announced their discovery of programmable DNA scissors, hinting at its potential as a genome editing tool. The groundbreaking paper that described CRISPR/Cas9 led to a Nobel Prize in chemistry for Jennifer Doudna and Emmanuelle Charpentier in 2020.

- 2017. Google AI researchers published their groundbreaking transformer model research. Their 11-page paper, “Attention Is All You Need,” revolutionized machine learning and laid the core foundation for modern generative AI.

If this cluster of technologies, emerging during a time of pessimism, turns out to form the foundations of a sustained period of elevated productivity and economic growth, it wouldn’t be the first time.

The Great Contraction (and productivity expansion)

The 1930s is synonymous with economic catastrophe. “Great Depression” immediately brings to mind images of soup kitchen lines, bank runs, apple sellers on street corners, and Dorothea Lange’s famous “Migrant Mother” photograph. Things were so bad that as World War II came to a close, many economists predicted a dark economic future for America. (Coming soon: The Great Depression — The Sequel.) MIT’s Paul Samuelson famously warned of “the greatest period of unemployment and industrial dislocation which any economy has ever faced.” Harvard’s Alvin Hansen predicted “secular stagnation,” arguing that key growth drivers had disappeared: Population growth had slowed, the geographic frontier had closed, and technological progress had matured.

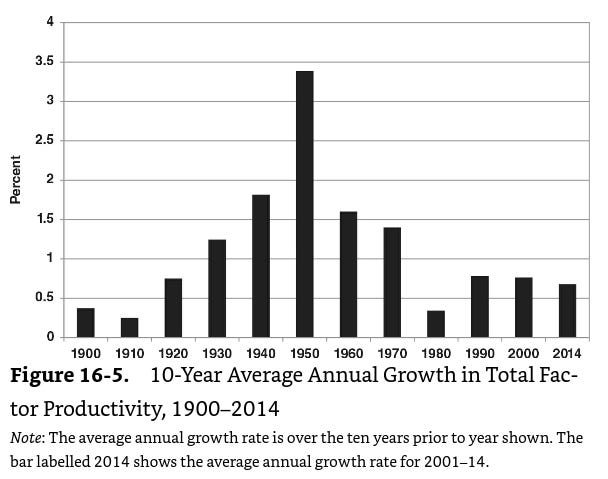

Surprise! Defying all those gloomy predictions, the postwar American economy boomed. Living standards doubled between 1948 and 1973, with the 1950s and 1960s marking the century’s fastest growth. This prosperity wasn’t just from pent-up demand — it reflected a genuine increase in productivity that was partly built upon a series of economy-wide innovations that happened in the 1930s: transportation and infrastructure (diesel-electric locomotives, concrete highway engineering), manufacturing (advanced welding techniques, machine tool improvements), chemicals and materials (synthetic rubber development, new plastics and polymers), and electrification (high-voltage transmission (enabled widespread electrification, electric motor control systems).

And that’s just a sampling, really, taken from A Great Leap Forward: 1930s Depression and U.S. Economic Growth by economic historian Alexander J. Field, who writes:

Although the Second World War provided a massive fiscal and monetary boost that eliminated the remnants of Depression-era unemployment, it was, on balance, disruptive of the forward pace of technological progress in the private sector. …It was the expansion of potential output during the Depression, largely unappreciated because it took place against a backdrop of double-digit unemployment, that laid the foundation both for successful war mobilization and for the golden age that followed.

(One wonders if the recent productivity surge suggests the pandemic was disruptive in the same way WWII.) Our most transformative technological leaps forward seem to emerge during dark hours of doubt and despair. Again today, amid swirling concerns about AI risks, climate change, and geopolitical tensions, we might just be witnessing the birth of another revolutionary era of human advance thanks to compute + energy + entrepreneurial capitalism. Students of the history of progress wouldn’t be surprised if we’re seeing the breaking of a new dawn. And now, you won’t be, either.

Sign up for the Ledger

Weekly analysis from AEI’s Economic Policy Studies scholars